The cryptocurrency market has been facing increased scrutiny from regulators around the world, especially in the United States. One of the major targets of this regulatory pressure is Binance, the world’s largest cryptocurrency exchange by trading volume. Binance has been under investigation by the U.S. DOJ and the Commodity Futures Trading Commission (CFTC) since 2018, for allegedly violating anti-money laundering and securities laws.

However, recent reports suggest that Binance is in talks with the US authorities to reach a potential settlement, which could involve a deferred prosecution agreement and a hefty fine of up to $4 billion. This news has sparked mixed reactions from the crypto community, with some fearing that it could harm Binance’s reputation and business, while others see it as a positive sign for the industry’s future.

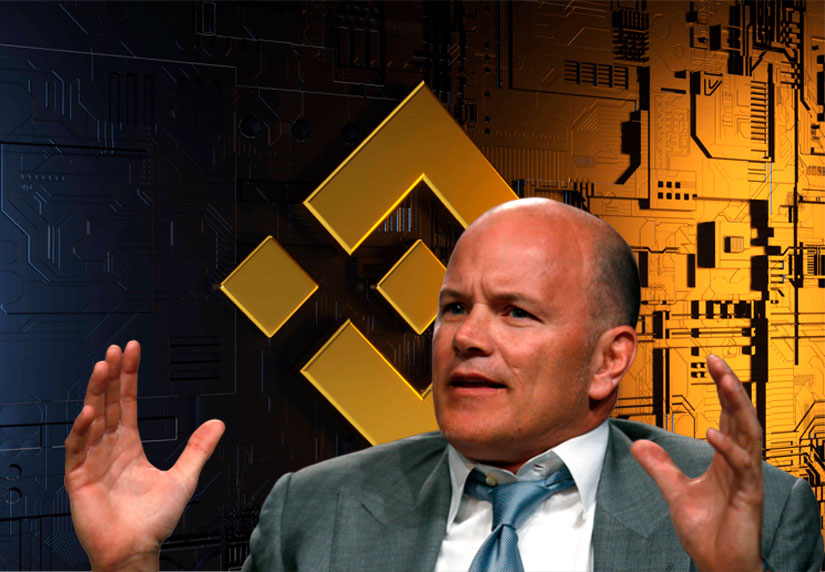

Mike Novogratz on the Binance-US Deal

One of the prominent voices in the latter camp is Mike Novogratz, the founder and CEO of Galaxy Digital, a leading crypto investment firm. Novogratz, who is also a former hedge fund manager and a billionaire, has expressed his optimism about the possible outcome of the Binance-US regulatory deal. In a tweet on November 20, he wrote, “It would be extremely bullish if Binance settled with the US regulators! I hope a resolution is reached and the sector can move forward.”

Binance setting with the US regulators would be super bullish!! Not sure if reports are true but I personally am hoping for a settlement and for the industry to move forward.

— Mike Novogratz (@novogratz) November 20, 2023

Novogratz’s view is shared by many other industry leaders and analysts, who believe that a settlement would bring more clarity and stability to the crypto market, as well as increase investor confidence and trust.

A settlement would also allow Binance to operate more freely and transparently in the US, one of the most important and lucrative markets for crypto. Binance has already taken steps to comply with US regulations, such as launching a separate platform, Binance.US, in 2019, and hiring former US Senator Max Baucus as a policy advisor in 2020.

The market’s reaction to the news of the potential settlement has also been surprisingly positive, as Binance’s native token, BNB, has surged by more than 10% in the past 24 hours, reaching $263 at the time of writing.

This indicates that the investors are not deterred by the prospect of a $4 billion penalty, but rather see it as a necessary cost for Binance to secure its long-term growth and success. As Novogratz put it, “Binance is a great company that has done a lot for crypto. They deserve a fair shake.”