TL;DR

- Bitcoin is soaring to historic highs in 2024, even before the halving, attracting investors’ and institutional capital’s attention.

- Long-term investors increase distribution pressure as BTC approaches $68,000, with GBTC representing a significant portion of the volume.

- Demand for BTC through ETFs contributes to a notable net capital flow of approximately $299 million daily, driving significant market dynamics and pushing BTC to new highs.

Bitcoin (BTC) has once again captured investors’ attention as it nears its all-time high, surprising the market with a strong surge even before the anticipated Halving. Investors closely watch how ETF demand interacts with long-term investors’ supply.

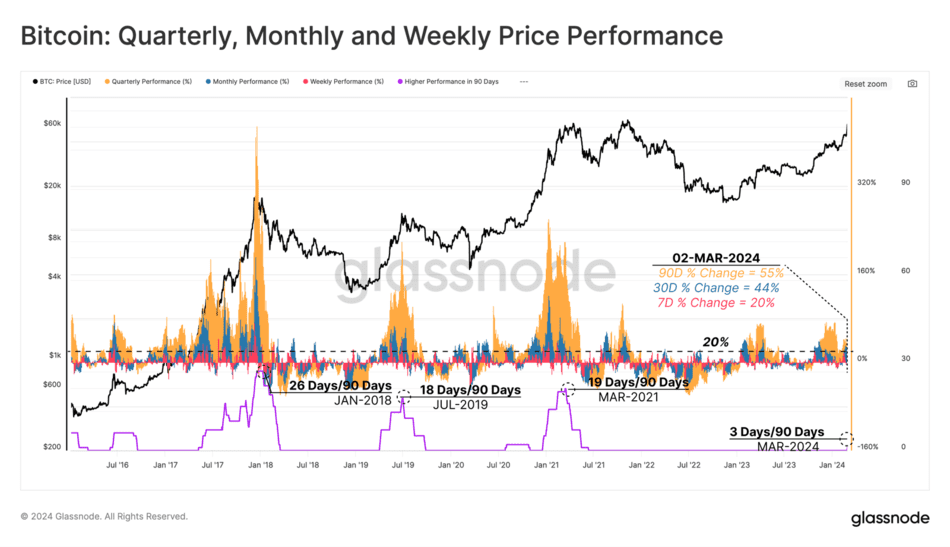

2024 has started spectacularly for Bitcoin, as the cryptocurrency heads towards new all-time highs, even before the halving expected in April. The recent surge has been partly driven by a sudden increase in the average transaction size interacting with Coinbase, suggesting significant new institutional capital entering BTC.

On the other hand, long-term investors have begun to increase distribution pressure, with spending rates of up to 257,000 BTC per month, with GBTC representing 57% of these volumes. This increase in distribution pressure coincides with a time when BTC has surpassed $68,000, representing a 58% increase from $42,800 at the time of ETF approval.

Bitcoin is Delivering Huge Profits

The increase in BTC demand through ETFs has been notable, with an aggregated net flow of around $299 million per day. This positive net flow has contributed to a significant shift in market dynamics, driving Bitcoin’s price towards new all-time highs.

With the current price hovering around $68,000, long-term investors are seeing unrealized gains of approximately 228% on average. This has led to an increase in distribution pressure from long-term investors, who are seizing the opportunity to take profits. It will be crucial to monitor BTC’s performance to position oneself as best as possible and make the right decisions when investing amidst a bullish surge.