TL;DR

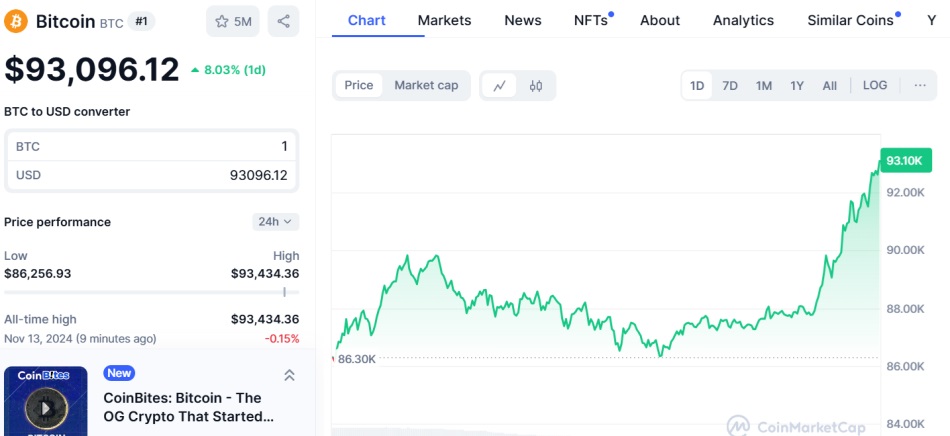

- Bitcoin reaches a new all-time high surpassing $93,000, driven by market optimism and the results of the U.S. elections.

- Analysts predict a short-term correction of up to 10% before the CPI report on November 13, with support levels between $66,729 and $64,130.

- Technical analysis indicates overbought conditions for Bitcoin, with an RSI of 75.20, suggesting potential downside pressure in the short term.

Bitcoin (BTC) has experienced a phenomenal price surge and reached a new all-time high, breaking the $93,000 barrier. The bullish streak has been driven by overall market optimism and positive results from the U.S. elections.

However, analysts foresee that BTC could face a short-term correction, particularly in anticipation of the Consumer Price Index (CPI) report set to be released on November 13, 2024.

Among the analysts commenting on this potential correction is Michaël van de Poppe, founder of MNConsultancy, who predicts that Bitcoin could experience a pullback of about 10% before the CPI release.

How Low Could Bitcoin Fall?

According to van de Poppe, the price could drop to levels between $75,669 and $81,193, with support around $66,729 and liquidity near $64,130. For him, this retracement would be a natural correction within the market cycle, seen as a healthy pause before Bitcoin continues its upward trajectory.

#Bitcoin is up to $90,000 and I think we're about to get started with the markets.

The sweet spot is having a 10% correction towards the CME gap before we continue.

I'm slightly bearish going into CPI tomorrow. pic.twitter.com/dfpUc2df1k

— Michaël van de Poppe (@CryptoMichNL) November 12, 2024

Additionally, BTC’s technical analysis suggests the asset is in overbought conditions, with the price above the upper Bollinger Band and an RSI of 75.20, which could indicate that the cryptocurrency may face downward pressure in the short term. This situation is viewed as a potential technical correction as the market adjusts to current conditions.

Correct to Rise

Changpeng Zhao, co-founder of Binance, also warned about the possibility of volatility in Bitcoin’s prices, especially due to the recent all-time highs reached by the cryptocurrency. Bitcoin’s recent behavior is generating expectations of sharp movements, and investors are preparing for the CPI report and the potential effects it may have on the market.

It is worth noting that this adjustment is not seen as an obstacle to the future growth of the cryptocurrency but rather as a pause before a possible recovery