TL;DR

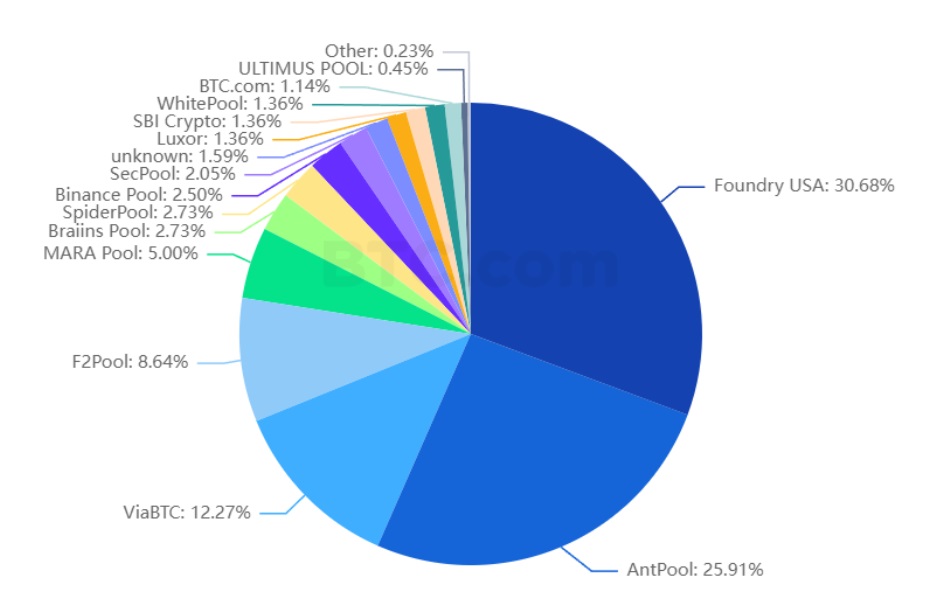

- Foundry USA and AntPool control 57% of Bitcoin’s hashrate, raising concerns about centralization.

- The concentration of power in a few pools increases the risk of a 51% attack, compromising the network’s security.

- The dominance of these pools could lead to transaction censorship and have geopolitical implications.

The growing centralization in the Bitcoin network has raised concerns within the crypto community. It was revealed that two major mining pools, Foundry USA and AntPool, now control 57% of the network’s total hashrate. This has sparked a debate about the potential risks that such concentration of power could pose to the decentralized structure that characterizes Bitcoin.

Foundry USA, owned by the conglomerate Digital Currency Group, and AntPool, operated by the Chinese company Bitmain Technologies, have become the leaders in Bitcoin mining. Recent data indicates that the network has a total hashrate of approximately 651 exahashes per second (EH/s), of which Foundry contributes 215.79 EH/s and AntPool 153.55 EH/s.

One of the main risks associated with this concentration of power is the possibility that a single mining pool could control more than 50% of the network’s hashrate, allowing it to carry out a 51% attack. In such an attack, the majority control of the hashrate would enable the pool to manipulate the network, invalidate transactions, or even reverse already confirmed transactions, compromising the integrity and security of the Bitcoin network.

A War for Bitcoin Dominance

Although no single pool currently has the capacity to execute such an attack, the growing centralization among a small number of actors increases the likelihood that this could happen in the future.

Moreover, the centralization of hashrate also raises geopolitical concerns. Foundry USA, aligned with U.S. interests, and AntPool, reflecting Chinese influence, represent two power blocs that could use their dominance in the BTC network for purposes beyond mere mining, such as transaction censorship.

In fact, there have already been instances in the past where mining pools have blocked transactions in compliance with economic sanctions, demonstrating that the concentration of mining power can have tangible consequences for the network.