TL;DR

- The US Bitcoin ETF market has experienced a notable increase in inflows, with a total inflow of $66.0 million, marking the largest increase since May 6.

- Fidelity’s ETF (FBTC) led this increase with an inflow of $38.6 million, bringing its total net flow to $8.2 billion.

- Bitwise (BITB) and VanEck (Hodl ETF) also saw increases, with inflows of $20.3 million and $7.1 million, respectively.

The Bitcoin ETF market in the United States has witnessed a significant increase in inflows, marking the largest increase since May 6, according to recent data from Farside. It was primarily highlighted by a total inflow of $66.0 million.

At the forefront of this increase was Fidelity’s ETF (FBTC), which garnered an inflow of $38.6 million, elevating its total net flow to approximately $8.2 billion. This inflow demonstrates that confidence in Bitcoin’s potential as an investment asset continues to solidify among both institutional and retail investors.

Following closely behind Fidelity, Bitwise’s ETF (BITB) recorded an inflow of $20.3 million, its highest level since May 3, bringing its total net flow to $1.8 billion. Additionally, VanEck’s Hodl ETF also experienced an inflow of $7.1 million, also its highest inflow since May 3, reaching a total net flow of $487.4 million.

Inflows Continue Despite Bitcoin Instability

A notable fact is that Grayscale’s Bitcoin Trust (GBTC) has not experienced any outflows or inflows. Marking the second time this has occurred since its launch. This could be interpreted as a pause in the recent trend of GBTC outflows. Indicating a potential stabilization in investor confidence in Grayscale.

Overall, the total inflows for all Bitcoin ETFs in the United States now exceed $11.7 billion, according to Farside data. There is renewed optimism surrounding BTC and cryptocurrencies in general, despite recent volatility and uncertainty.

At the time of writing this article, BTC is trading at $61,505. It is trading lower, with a 2% decrease in the last day. The trading volume in the same period was $28,569,589,349. Its market capitalization is approximately $1,212,811,331,014, according to data provided by Coinmarketcap.

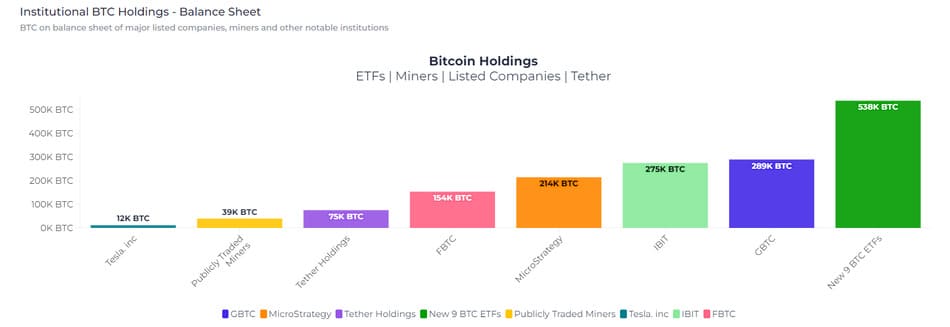

On the other hand, it is noted that BlackRock IBIT is now 14,651 BTC behind GBTC. Holding a total of 274,836 BTC compared to GBTC’s 289,487 BTC. The nine BTC ETFs collectively hold approximately 538,000 BTC.