TL;DR

- Bitcoin mining profitability reached historic lows on August 5, with a “hash price” below $36 per PH/s.

- Major mining companies are adopting various strategies to face the crisis, from holding BTC reserves to liquidating all mined assets.

- Mining difficulty reached a record high of 90.6 trillion on August 1. With a possible 5% decrease expected on August 14.

The Bitcoin (BTC) mining industry is experiencing an economic crisis due to the decline in operational profitability, exacerbated by an unprecedented increase in mining difficulty. After the April halving, miners’ profit margins have been significantly reduced, reaching a critical point on August 5 when profitability plummeted to historic lows.

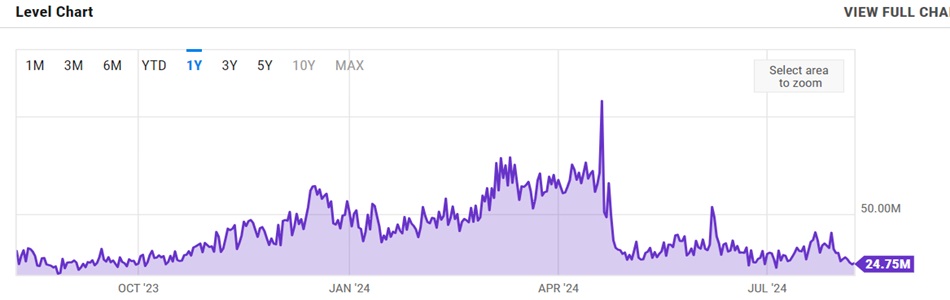

The “hash price,” an indicator that measures earnings per unit of processing power, fell below $36 per petahash per second (PH/s), a threshold never before seen in the sector. This drop in profitability has raised concerns in the industry, especially among large publicly traded mining companies such as Marathon, CleanSpark, Core Scientific, and Riot Platforms, whose production costs currently exceed $60,000 per Bitcoin, reaching an average of $83,600 on August 7.

Bitcoin Could Offer Miners a Respite

To mitigate the adverse effects of this situation, companies have adopted different strategies. While Marathon and Riot Platforms opted to hold their Bitcoin reserves in anticipation of a possible future price appreciation, Core Scientific took the opposite approach, liquidating all mined bitcoins to cover its operational costs. CleanSpark, meanwhile, revealed that it only sold a small fraction of the BTC it mined in July. Reflecting the uncertainty and caution with which companies are managing their assets in a volatile market.

In addition to the challenge posed by declining profitability. BTC mining difficulty reached an all-time high on August 1, standing at 90.6 trillion. This increase in difficulty, which determines the complexity of calculations needed to mine a block. Has added significant pressure on miners, as it implies more processing power is required to obtain the same reward. However, mining difficulty is expected to decrease by approximately 5% in the next adjustment on August 14. Which could provide temporary relief to mining operations