TL;DR

- Cardano (ADA) experiences a notable increase in fund inflows while Bitcoin faces a $600 million capital outflow, the highest since March 2024.

- The restrictive FOMC meeting contributes to the bearish trend in Bitcoin, prompting investors towards alternative assets like Cardano.

- ADA is preparing for the Chang hard fork, eagerly anticipated by the community to strengthen the platform and maintain its appeal in the crypto market.

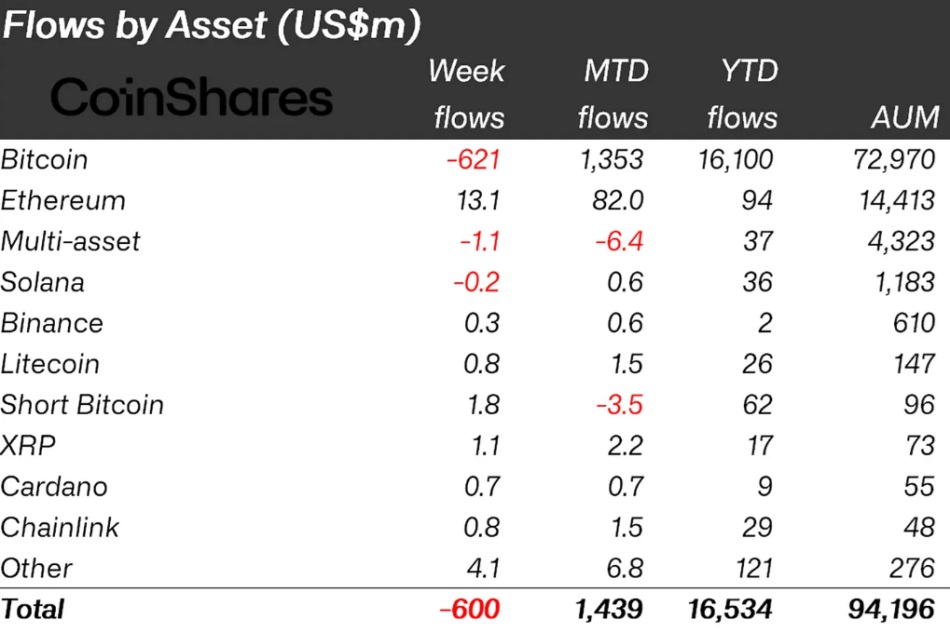

Amidst the bearish market, Cardano (ADA) is emerging as a protagonist with a significant rise in fund inflows, while Bitcoin faces a strong capital outflow. According to CoinShares data, digital asset investment products saw a total outflow of $600 million, marking the highest figure since March 2024.

The bearish trend is mainly attributed to the more restrictive-than-expected Federal Open Market Committee (FOMC) meeting, which motivated investors to adjust their positions in fixed supply assets like Bitcoin.

In contrast, Cardano attracted fund inflows, receiving $0.7 million during the analyzed period. The positive flow occurs in a context where several altcoins showed active performance in terms of investment, highlighting investors’ preference for alternative assets over traditional ones like Bitcoin. The contrast between Bitcoin’s $621 million outflow and Cardano’s modest inflows underscores a discernible shift in market preferences towards more dynamic digital assets.

Cardano Community Awaits ‘Chang’ Hard Fork

Encouraged by these results, the ADA community eagerly awaits upcoming network updates. The highly anticipated Chang hard fork is expected to further enhance platform capabilities and security. This update could be crucial in maintaining ADA’s attractiveness among investors and solidifying its position in the competitive crypto market.

However, ADA’s current price shows a 3% decline over the past 24 hours, trading at approximately $0.4026 per unit, reflecting general selling pressures affecting the overall market. This context emphasizes the importance of understanding and analyzing overall market trends and investor sentiment. These factors could significantly influence Cardano’s future price trajectory.

Cardano stands as a key player in the current market, demonstrating strength in fund inflows amid significant capital outflows. Investors closely monitor the platform’s upcoming developments and market dynamics that could impact its valuation.