A recent report from CoinShares presents a cautious outlook on the profitability of Bitcoin miners after the upcoming Halving, scheduled for late April. According to the report, the significant increase in the number of active miners and the imminent reduction in BTC block rewards could threaten the financial stability of many validators after the halving.

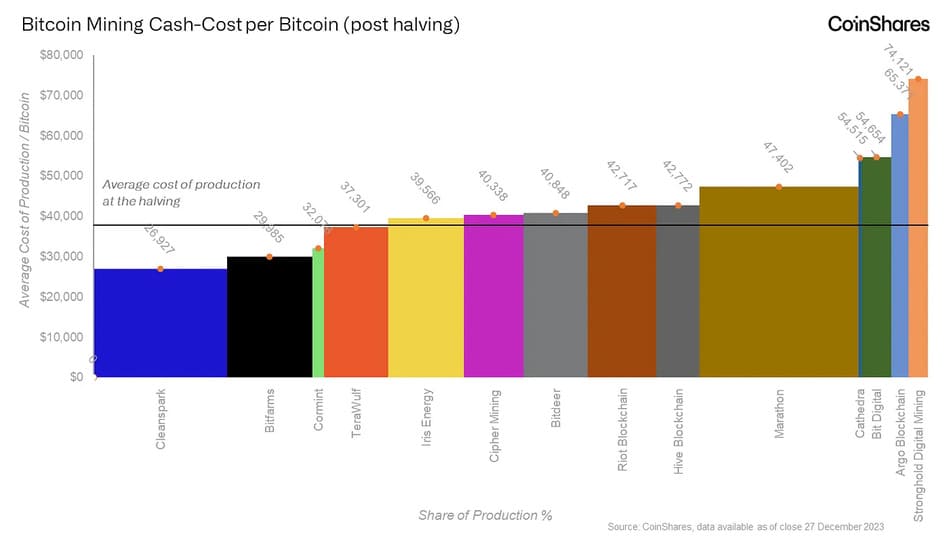

CoinShares estimates an average production cost of $37,856 per BTC after the upcoming halving, which will reduce the rate of issuing new bitcoins from 6.25 BTC to 3.125 BTC per block. The company highlights that due to the 90% increase in the Bitcoin mining network in 2023, questions arise about environmental sustainability and the profitability of this growth. Miners with higher costs may face difficulties due to a decrease in immediate income. Only a limited number of miners are expected to remain profitable if Bitcoin prices stay above $40,000.

After the Halving, Many Inefficient Miners Will Be Forced Out of the Market, and Bitcoin Could Rise

CoinShares emphasizes that Bitcoin’s hash rate experienced a 104% increase in the past year, indicating intensified competition for block rewards. However, the report anticipates a decline in the network’s hash rate as inefficient miners struggle to remain profitable, facing a combination of reduced block rewards and an increase in mining difficulty.

This CoinShares analysis comes at a time when the price of BTC is under pressure after the early approval of the first U.S.-based Bitcoin ETFs, resulting in a sell-off in reaction to the news. Although the market faces a retreat, some experts predict that the halving could catalyze future increases in the price of BTC, as historically observed in this four-year cycle.

The company backs its claims with historical data, showing that the network’s hash rate experiences increases before block reward reductions, followed by declines in the six months after the event as inefficient miners are removed from the market for becoming unprofitable.