The cryptocurrency market witnessed a strong bullish momentum on Friday, as both Bitcoin and Ethereum surged to new highs, liquidating over $90 million worth of short positions in the process.

Bitcoin, the leading cryptocurrency by market capitalization, broke above the $40,000 resistance level after trading below that mark since the approval of Spot ETF, reaching a high of $41,960 at the time of writing. The move was accompanied by a significant increase in trading volume and a sharp decline in the funding rate of perpetual futures contracts, indicating that the market sentiment has shifted from bearish to bullish.

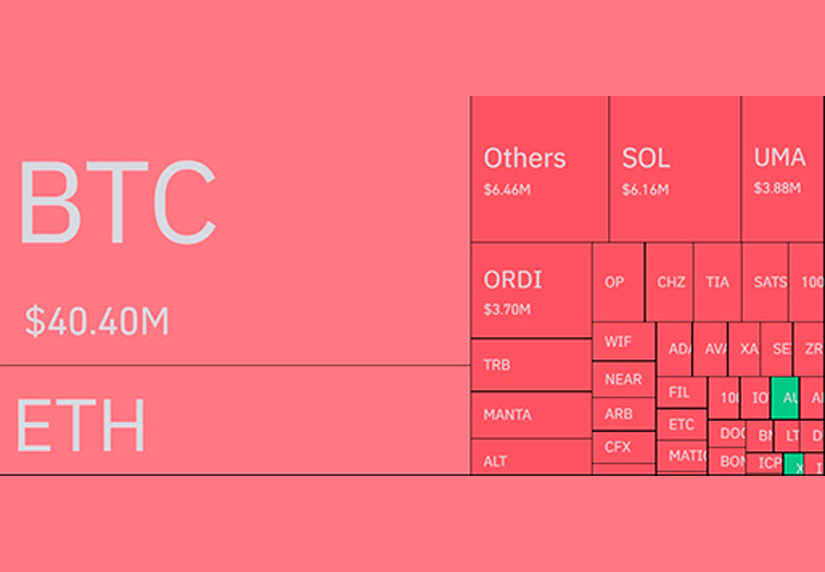

According to data from Coinglass, a crypto derivatives analytics platform, over $90 million worth of short positions were liquidated in the past 24 hours, with the majority of them occurring on Binance, the largest crypto exchange by volume. The liquidations were triggered by the rapid price increase, which forced the traders who bet against the market to close their positions at a loss or face margin calls.

The Reasons Why Ethereum Rallied to a New Two-Month High

Ethereum, the second-largest cryptocurrency by market cap, also followed Bitcoin’s lead and rallied to a new two-month high of $2,250, breaking above the $2,000 resistance level that had been holding it back. The move was supported by the positive news from the Ethereum network, which is preparing for a major upgrade called “Dencun” that will introduce Proto-Danksharding.

The bullish momentum of Bitcoin and Ethereum also spilled over to the rest of the crypto market, as most of the top 10 coins by market cap posted double-digit gains in the past 24 hours. The total market cap of all cryptocurrencies increased by over 10% to $1.63 trillion, according to CoinGecko, a crypto data aggregator.

As the weekend approaches, many traders and analysts are expecting the crypto market to continue its upward trend, as the technical indicators and the fundamentals are in favor of the bulls. However, some caution is also advised, as the market is still prone to volatility and unexpected reversals. Therefore, it is important to have a risk management strategy and not invest more than one can afford to lose.