In recent weeks, the decentralized finance (DeFi) market has experienced a remarkable recovery, reaching levels not seen for several months.

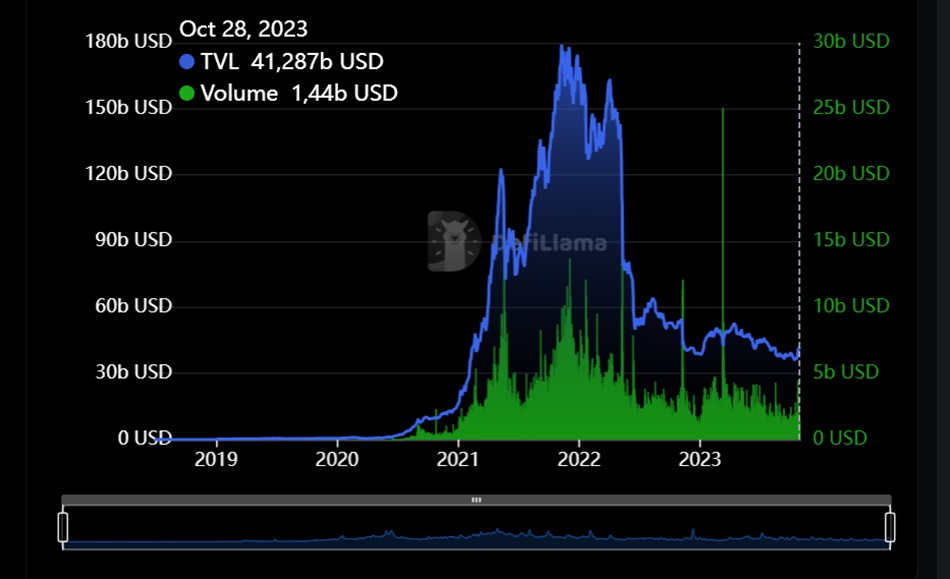

After hitting its lowest point in 30 months, with a total locked value in DeFi protocols of approximately $35.8 billion, the sector underwent a rapid rebound, surpassing $42 billion in a short time according to DefiLlama.

The recovery is based on two key factors. First, the increase in asset prices has been significant.

Ethereum (ETH), which serves as the foundation for most DeFi protocols, experienced a surge from $1,590 to $1,810 in the last two weeks.

Furthermore, other cryptocurrencies such as lido (LDO) and aave (AAVE) also displayed significant gains, with increases of 25% and 34%, respectively.

The second factor is the influx of new funds from participants seeking to generate yields through staking and lending.

This capital inflow has been accompanied by an increase in transaction volume within DeFi protocols, reaching its highest point since March, with $4.4 billion in transactions recorded on October 24th.

DeFi is much more than just Ethereum

The expansion is not limited to Ethereum; other blockchains are also witnessing significant growth in total locked value.

For instance, Solana saw an increase in its most extensive lending protocol, Marinade, which experienced a 120% rise in total locked value this month.

This occurred following the launch of its native staking product, which offers yields of 8.15% APY, complemented by a 7.7% rate for liquid staking.

Its competitor, Jito, also witnessed a growth of 190%, reaching $168 million in total locked value during the same period.

Capital in protocols like Enzyme Finance, Spark, and Stader has increased between 37% and 55%, surpassing the rise in asset prices and indicating an influx of new funds.

However, caution should never be lost. Even the slightest drop in the price of Ethereum could trigger significant on-chain liquidations.

For instance, there is a $76.2 million position in Aave that would be liquidated if the Ethereum price falls below $1,777, with over $100 million at risk if the price drops by 20%.