TL;DR

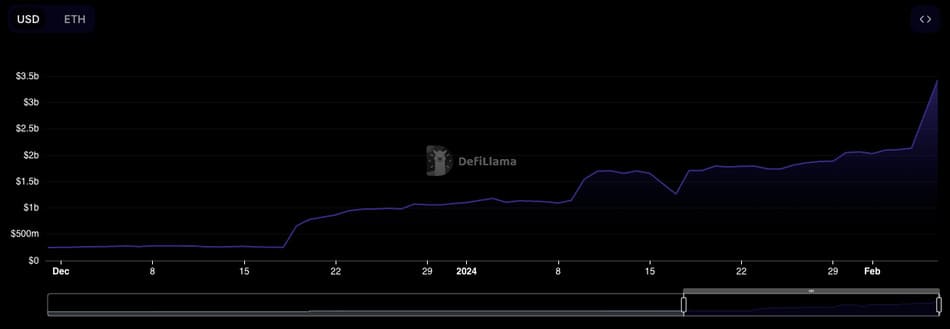

- EigenLayer experienced a massive increase in its total value locked (TVL) after temporarily removing staking caps, surpassing $1 billion.

- The temporary removal of staking caps was aimed at fostering organic demand on the network and enabling a rapid increase in user participation on the platform.

- The protocol also plans to permanently remove all staking caps in the future, paving the way for a restriction-free ecosystem for users.

EigenLayer, an Ethereum-based protocol facilitating liquid staking of ETH tokens. Saw a significant surge in its total value locked (TVL) after temporarily removing staking caps. This decision, announced on February 5, led to an exponential growth in TVL within a short period. In just eight hours. EigenLayer’s TVL increased by $1 billion, marking a historic moment for the protocol.

The temporary removal of staking caps was aimed at fostering organic demand on the network. Before this decision. EigenLayer maintained a staking cap of 200,000 Ether per protocol. However, the temporary removal of this cap opened the door to a rapid increase in user participation on the platform.

🟦 EigenLayer Restaking Reloaded! 🟦

From NOW until Feb 9th, 12 PM PT, dive back into the world of LST restaking! All pools are fully uncapped, featuring both the existing pools and welcoming new partners @fraxfinance, @liquid_col, & @0xMantle. pic.twitter.com/yDGHiJjX3m

— EigenLayer (@eigenlayer) February 5, 2024

EigenLayer Plans to Eliminate All Staking Caps on Its Platform

The growth in EigenLayer’s TVL was reflected in the massive influx of ETH tokens into the protocol during the three-day period when staking caps were removed. This increase in protocol adoption suggests growing interest from investors in participating in the liquid staking of ETH tokens.

In addition to the temporary removal of staking caps. EigenLayer also announced its intention to permanently eliminate all staking caps in the future. This move aims to pave the way for an ecosystem where there are no restrictions for users wishing to participate in the liquid staking of their tokens on the EigenLayer network.

The protocol offers investors the opportunity to earn additional returns on their ETH tokens through liquid staking. Where tokens are used to secure other networks. With support for liquid staking tokens such as Lido DAO’s stETH and Swell Stated Ether (swETH). EigenLayer has managed to attract a significant amount of total value locked to its platform.

Despite the success and rapid growth, some concerns have been raised by market analysts and developers. It was noted that high volumes of restaking could introduce risks similar to leverage in the protocol. Furthermore, Ethereum co-founder Vitalik Buterin’s warning about the systemic risks associated with a significant increase in restaking raises questions about the long-term sustainability of the protocol’s business model. Continuous scrutiny is required to address the concerns raised and ensure the safety and stability of the ecosystem as it continues to grow and evolve.