TL;DR

- Fund flows in the digital asset market over the last week have been significant for Ethereum and Bitcoin, as well as other altcoins and financial products.

- Ethereum saw outflows of over $23 million, while digital asset products overall received $932 million in inflows.

- Ethereum is heavily affected by uncertainty surrounding the SEC’s decision on Ethereum-based ETFs.

During the past week, the digital asset market has seen significant movements in fund flows, especially concerning Ethereum (ETH) and Bitcoin (BTC), along with other altcoins and financial products.

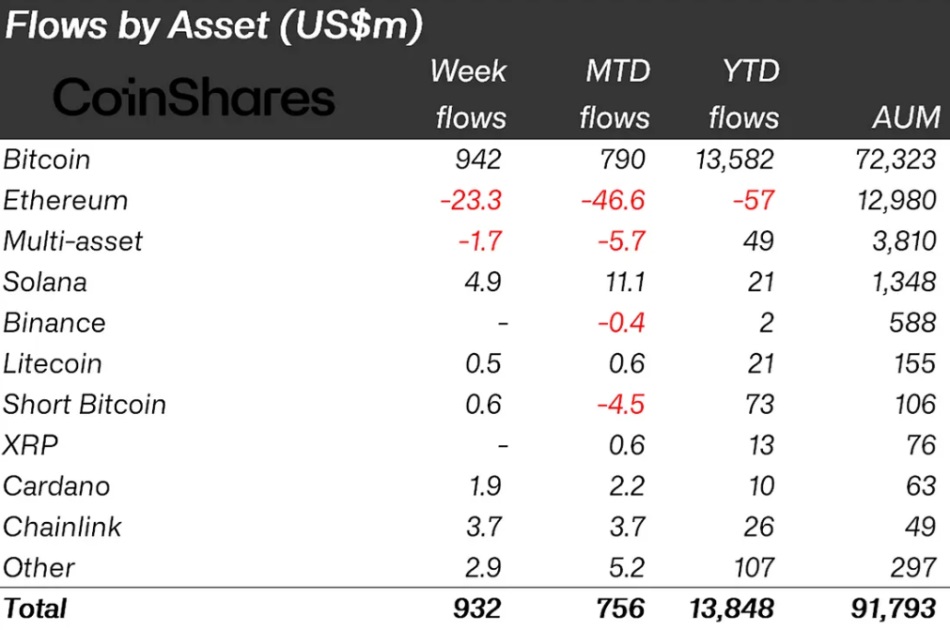

According to the report from asset management firm CoinShares, ETH funds experienced outflows of over $23 million during the week, despite digital asset products overall receiving $932 million in inflows. The negative trend in Ethereum flows is largely attributed to uncertainty surrounding the approval of an ETH ETF by the U.S. Securities and Exchange Commission (SEC), causing skepticism among cryptocurrency investors.

On the other hand, Bitcoin remains the preferred asset for investors, attracting $942 million in inflows during the same period. Its upward trend reflects a widespread positive sentiment among investors regarding BTC, with minimal fund flows directed towards short BTC positions, indicating an optimistic market outlook for the leading cryptocurrency.

Ethereum Falls Behind Other Cryptocurrencies

Additionally, several altcoins also experienced fund inflows during the week. Solana, Chainlink, and Cardano received $4.9 million, $3.7 million, and $1.9 million, respectively, demonstrating continued and growing interest in alternative projects within the cryptocurrency space.

While fund flows into digital products have increased overall, total trading volume was relatively low, reaching only $10.5 billion during the week. This contrasts sharply with the $40 billion seen in March, indicating more moderate trading activity in the short term.

Regionally, the United States led in fund inflows, followed by Switzerland and Germany. However, Hong Kong and Canada experienced fund outflows, reflecting some volatility in certain regions.

Although uncertainty persists in certain aspects, overall interest in cryptocurrencies seems to remain solid. We will have to wait for the final resolution regarding Ethereum ETFs to see the immediate and long-term impact it has on the second-largest cryptocurrency by market capitalization.