TL,DR

- Renewed optimism surrounds Ethereum due to the increase in open interest in ETH options for late April.

- Over $3.3 billion in options ready to expire by late April, with roughly two-thirds placed in bullish bets.

- The put-call ratio for Ether options expiring in late April is 0.45, indicating a more bullish position compared to Bitcoin options.

There is renewed optimism surrounding Ethereum (ETH) thanks to an uptick in open interest in Ether options expiring in late April.

Open interest in Ether options, representing contracts to buy or sell ETH at a specified price on a specific date, has reached significant levels for the late April expiry. This increase suggests a positive sentiment towards bullish trends in ETH price in the short term.

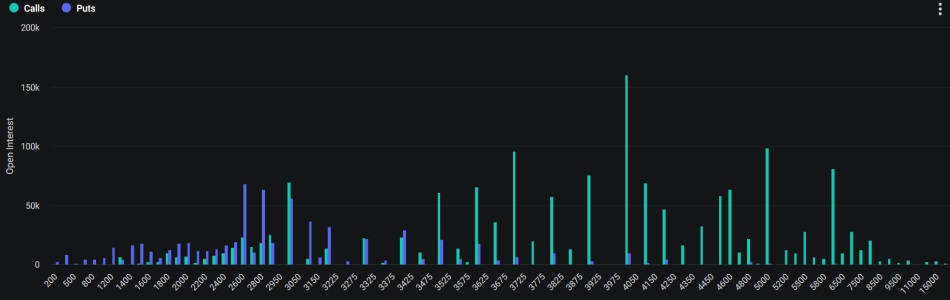

According to Deribit data, it’s estimated that there are over $3.3 billion in notional Ether options ready to expire by late April. Additionally, roughly two-thirds of this amount was placed in calls, meaning bullish bets on the price of Ether.

Calls are concentrated between exercise prices of $3,700 and $4,000, demonstrating the underlying bullish sentiment in the market. Apparently, investors expect the price of Ether to continue rising in the coming weeks.

Analysts Warn of Risks from Likely Rejection of Ethereum ETFs and New Regulations

Furthermore, the put-call ratio for options expiring in late April is currently at 0.45. Indicating a more bullish position compared to Bitcoin options. When the put-call ratio is below one, it suggests there is more volume in call options than in put options. Reflecting a generally bullish sentiment in the market.

However, analysts warn of potential risks, especially from the negative impacts of regulatory changes on Ethereum. Due to the Securities and Exchange Commission’s (SEC) repeated attempts to classify it as a security. Additionally, the low probability of approval for an Ether ETF by June 2024 could also affect market sentiment.

Beyond the overall optimism, it’s important to consider potential regulatory and market risks associated with Ethereum when considering any position in the crypto market.