Inflation is an economic condition that, when unanticipated, can have a resounding impact on household purchasing power, but also on your investments. What is it exactly? How is inflation calculated? What forms can inflation take? What are its causes and effects? How has inflation evolved in 2022? Learn about the pros and cons of inflation and find a replay of our video conference on which investments to focus on during inflationary periods and which to avoid.

What is inflation?

Inflation is a steady (structural) or transient (cyclical) increase in the general price level of goods and services. It is measured over a year and is usually presented as a percentage change. When inflation increases, the purchasing power of each euro you own decreases. And the opposite is true when it decreases.

For example, if the inflation rate is 2% per year, then theoretically a 1 euro pack of chewing gum will cost 1.02 euros after one year. After inflation, your money will not be able to buy the same goods as before. This is why the question is often asked whether regulated savings investments such as the Livret A have an interest rate that at least covers inflation. The whole issue is then not even to see his investment earn but that it does not ” cost “.

Deflation, hyperinflation, stagflation: the different variations of inflation

There are several variations around inflation.

Deflation or the opposite of inflation

This is when the general price level falls. It is the opposite of inflation.

Hyperinflation: very rapid rise in prices

This is exceptionally rapid inflation. In extreme cases, it can lead to the collapse of a country’s monetary system.

One of the most prominent examples of hyperinflation occurred in Germany in 1923, when prices rose by 2,500% in one month, or even more recently in Venezuela in 2018, with inflation of over 1,000 000% per year!

Stagflation: low growth and high inflation

This is the combination of high unemployment and economic stagnation accompanied (paradoxically) by high inflation. This is what happened in the industrialized countries in the 1970s when a weak economy was associated with an OPEC (OPEC’s forerunner) driven increase in oil prices.

While low unemployment and high inflation are not the same thing, they are the same thing

While there is much talk of inflation in 2022, according to some analysts we could be entering a period of stagflation this year. At this point, this is just speculation of course, although as time goes on, the assumption looks more and more like a plausible scenario.

In recent years, most of the developed world has tried without much success often to keep inflation around 2% through their central banks. Inflation between 2 and 3 percent is considered by macroeconomists to be healthy for a country’s economy.

What is the inflation in 2022?

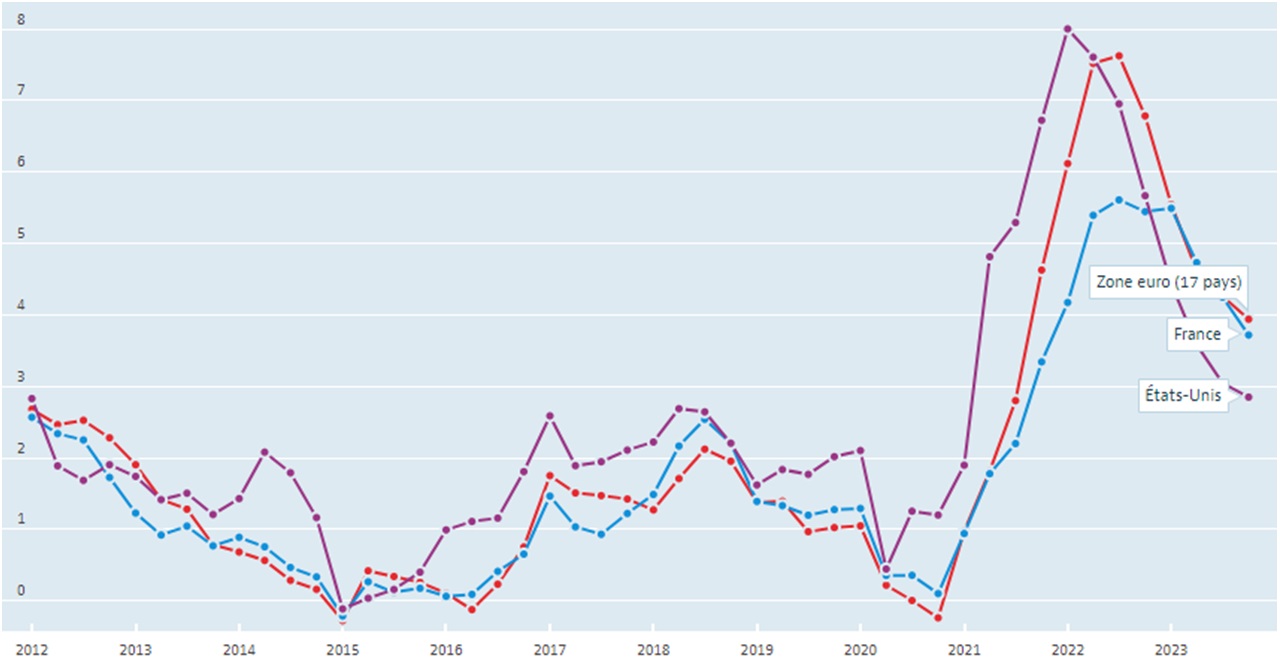

Between 2012 and 2021, inflation in the U.S. and Europe remained under control (contained between -0.5% and +3%), before starting to grow significantly from early 2022 to reach the following thresholds:

In the 1st quarter of 2022:

- United States: +7.9%

- Eurozone: +6.1%

In the 2nd quarter of 2022:

- United States: +8.6%

- Eurozone: +8.0%

In the 3rd quarter of 2022:

- United States: +8.3%

- Eurozone: +9.3%

In Q4 2022 (October only):

- United States: +7.7%

- Eurozone: +10.7%

However, the OECD forecasts a sharp reduction in inflation in the 4th quarter of 2023. It is expected to fall to the following levels:

- United States: +2.8%

- Eurozone: + 3.9%

Inflation rate chart and its projections in Eurozone and the United States from 2012 to 2023

As is often the case during inflationary economic phases, energy is the main cause. Its rate reached +44% in March 2022 for the Eurozone, in correlation with the significant rise in oil and gas prices. It should be noted, moreover, that inflation in other families of goods and services remained contained in thresholds below +4%, except for processed food, alcohol and tobacco (+4.1%) and especially for unprocessed food (+7.8%).

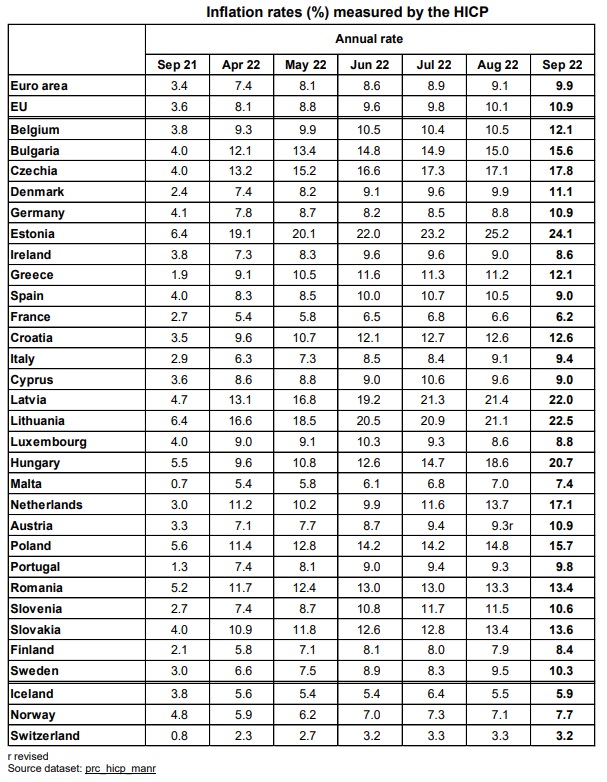

The inflation rate in the Eurozone has been rising since the beginning of the year

Annual inflation rates for European countries from September 2021 to September 2022

Source : eurostat

The causes of inflation: demand and cost inflation

The causes behind inflation generate discussion among economists. There is no single cause approved by all but two theories are generally accepted.

Demand-side inflation

This theory can be summarized as “too much money for too few goods.” In short, if demand increases faster than supply, prices will rise.

This happens often in developing economies, and was particularly at play with the economic rebound that occurred in 2021 with the end of the health crisis related to the COVID 19 epidemic. Resurgences of Covid-19, particularly in China, which adopted a zero Covid policy and again shut down part of its economy in the 1rst half of 2022, further increased the strain on supply chains. In addition, the war in Ukraine and its attendant economic sanctions have further increased pressure on commodity prices and particularly agricultural commodities and energy commodities. As a result, demand is far greater than supply.

Inflation through costs

When companies’ costs rise, they must raise prices to maintain profit margins. Rising costs can refer equally to fuel costs, wages, taxes, raw materials, and rising import costs.

The health crisis, with some sectors slowing down or even coming to a complete halt at the height of the epidemic, has caused a shortage of certain raw materials or components used in the manufacture of many products, the prices of which have consequently soared.

The consequences of this situation are still with us and when the vicious circle of inflation is set in motion, it can last for months before being resolved. One example is the shortage of semiconductors which is penalizing many sectors from IT to automotive.

While the semiconductor shortage was at the center of discussions in 2021 and since the beginning of 2022, it is the rise in energy and raw material prices due in particular to the war in Ukraine that seem to have initiated the end price increase in 2022, causing a massive rise in production costs.

Inflation : a good or bad thing for purchasing power?

The costs that inflation brings

Everyone believes that inflation is a bad thing, but that is not always the case. Inflation affects different economic actors and in different ways. It depends on whether or not inflation was anticipated. If the inflation rate is what the majority of the population expected (anticipated inflation), then it is possible to compensate and the costs will not be high.

For example, banks can change their interest rates and employees can negotiate contracts that include automatic wage increases as the price level rises. In this context, the decisions of the various central banks such as, for example, the FED (the U.S. Federal Reserve) or the ECB (European Central Bank) are very closely watched because they give a clue about the anticipated level of inflation.

Problems arise when inflation has not been anticipated

When there is structural inflation, creditors lose and debtors gain if the lender does not anticipate inflation correctly. For those who borrow at fixed rates, this is equivalent to being given a loan with no interest to pay.

Let’s imagine that Mr. X has taken out a home loan at a fixed rate of 4% over 20 years that costs him €500 per month (principal repayment + interest) on his €1,800 salary. Inflation over this period was +10% and his salary followed this inflation rate. The share of his monthly expenses related to the repayment of his mortgage has therefore mechanically decreased because it remains at 500 € while his salary is now 1 980 €. Mr. X therefore sees an increase in his purchasing power because his fixed-rate loan has not kept up with inflation.

Thus, inflation reduces debt, as the Think Tank BSI Economics points out. And this is also true for states. Indeed, in history, government deficits have been paid off more often through inflation than through the introduction of new taxes.

But inflation is not the only way to reduce debt

But there are other negative aspects to unanticipated inflation as well. For example, uncertainty about the future that can induce business and consumer spending caution, which in the long run affects economic output. Stock markets are also affected by unanticipated inflation, due to a more pronounced tendency to save rather than invest, during these periods of uncertainty.

People on fixed incomes, such as retirees, see their purchasing power as well as their standard of living reduced if their indexations are lower than inflation.

The entire economy must absorb the revaluation of costs (“menu costs”) as list prices, labels, menus, and many other things must be updated.

Note also that if a country’s inflation rate is higher than other countries, domestic products become less competitive.

Finally, recall that inflation is beneficial to individuals if the rise in prices is accompanied by at least an equivalent rise in wages, which is not always the case.

Have wages kept up with inflation over the long run ?

Let’s take the case of inflation in France over the very long run (30 years, from June 1991 to June 2022) : cumulative inflation is +61.2% over this long period while the French minimum wage has risen from €841 in July 1991 to €1,603 in January 2022, a growth of +91%.

According to these economic indicators, the purchasing power of the French has increased by +30% relative to inflation between 1991 and 2021.

Yet, in reality, the general public tends to see a loss of purchasing power over the long term, especially since the switch to the euro. This difference is related to perceived inflation, which can be significantly out of line with that calculated by economic statistics.

People like to complain about rising prices but often ignore the fact that this means that wages should rise as well. The real question is not whether or not inflation is rising, but rather whether it is rising faster than wages.

Finally, inflation is often a sign of economic growth. In some cases, little inflation (or even deflation) can be as bad as high inflation. No inflation at all can indicate a weak economy. So it’s not so simple to characterize inflation favorably or unfavorably; it depends on both the economy as a whole and your personal situation.

What method of calculating inflation? Focus on HICP

Harmonized Consumer Price Index : definition and reference basket

The Harmonized Index of Consumer Prices (HICP) is calculated by INSEE and its main role is to measure the price stability of the European Union member states. Its release frequency is monthly.

The consumption basket used to calculate the HICP includes all goods and services above 1 / 1,000 of total household final monetary consumption expenditure. This basket is classified according to the ECOICOP (European Classification Of Individual Consumption according to Purpose).

Since the beginning, the composition of the basket used as a reference for the HICP has evolved well. Indeed, in 1946, at its origins, the consumer price index included only 13 items related to basic consumption. It was later expanded to 34 items (29 food, 4 related to heating and lighting, and soap).

To date, the CPI (Consumer Price Index) is set from thousands of references.

The difference between the HICP and CPI

The HICP is calculated according to standardized European Union guidelines while the CPI is determined according to national guidelines. The HICP therefore finds comparative interest within EU countries because its bases of calculation are identical.

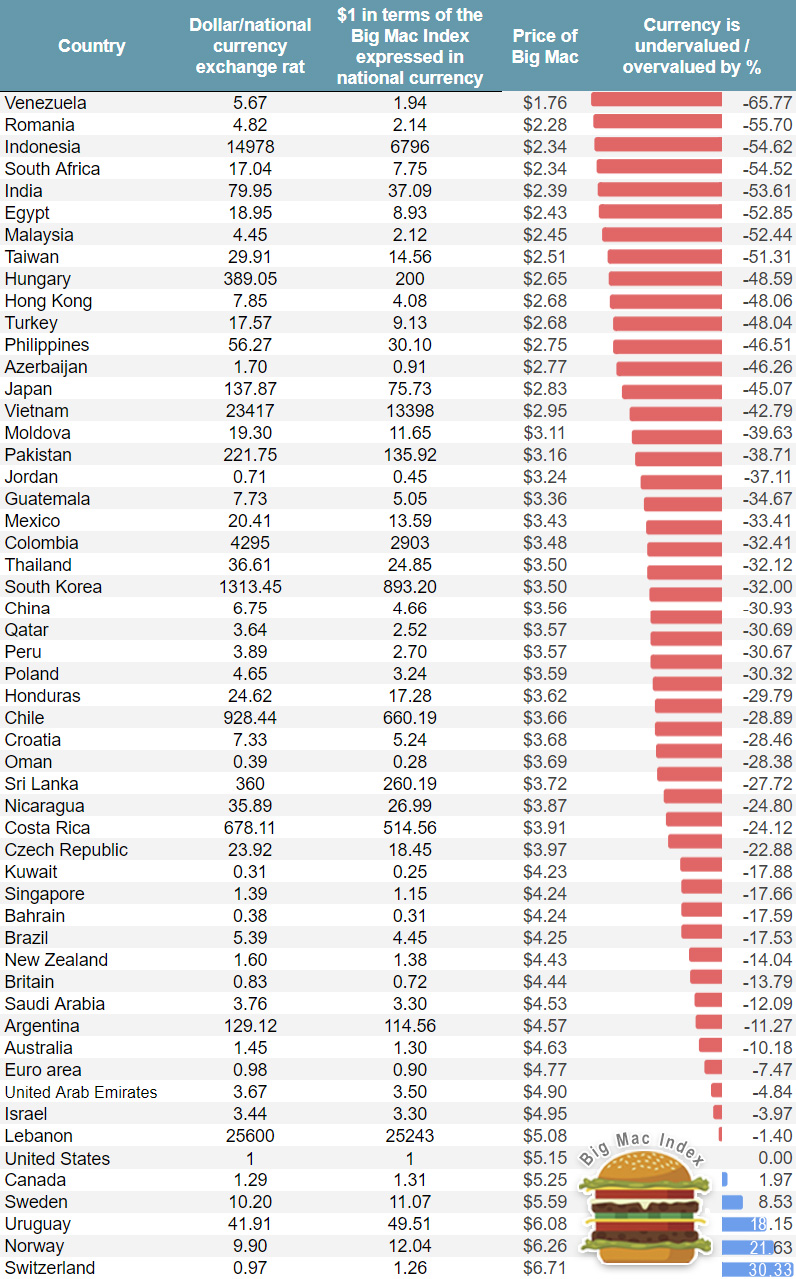

The Big Mac Index, an alternative economic indicator for getting a handle on inflation

One of the most commonly used economic indicators in the world to measure the cost of living is the Big Mac Index. This benchmark consumer product actually makes it easy to compare purchasing power between countries around the world. It currently ranges from $1.76 in Venezuela to $6.71 in Switzerland.

Big Mac Index 2022

Source : FXSSI

Returning inflation: how to invest in the stock market

Discover in video what attitude to adopt on the stock markets in 2022 given inflation. In particular, we’ll go over the assets to protect against inflation as well as the financial products to take advantage of it.

Investments to protect against inflation

Gold

Gold is the historical and most popular hedge against inflation. It performs well in a long-term inflationary environment like in the 1970s when its price increased more than 10-fold over the decade when inflation rates were high, around 5-10% per year. Gold is a safe haven when the economy is turbulent. Investing in gold preserves the value of your assets and your purchasing power. It derives its safe haven status from its tangibility, its rarity, and the fact that it is not backed by any institution (unlike currency).

While it is generally recommended to hold a portion (5% to 10%) of one’s investment portfolio in gold (bullion, ETFs); beware, however, as the yellow metal has not always played its role as a safe haven against inflation. Gold is also a financial asset around which there is a lot of speculation, and an overexposure to gold could lead to unpleasant surprises.

Real estate and SPCIs

Real estate and a fortiori SCPIs (Sociétés Civiles de Placement Immobilier), can be interesting investments in case of inflation. In the same way as gold or commodities, it is a tangible asset – stone – which during inflationary phases tends to appreciate. Thus, the value of the asset will tend to increase along with inflation. Note also that the rent reference index is indexed to inflation, which is particularly advantageous for the lessor who will not have to suffer inflation. The yield is therefore preserved in case of rental investment.

Still, let’s point out that the real estate sector has been the subject of speculation in recent years due to low borrowing rates. In this context, a rate increase due to inflation could have a negative impact on the real estate market.

Commodities

Inflation is by definition directly linked to commodity prices. It is therefore interesting to hold them to cancel out their effects. They are real, tangible assets, necessary to the economy. Thus, in the event of inflation, the price of commodities increases because they retain their use value, particularly with regard to energy (oil & gas), the main sources of inflation in the first half of 2022. Beware, in case of inflation reflating the price of raw materials may fall.

Shares in the stock market

Some stocks of companies on the stock market, in a context of inflation linked to a period of economic growth, are an interesting asset class, especially if they are able to adjust their price quickly (this is what we call pricing power). Examples include major brands, luxury goods companies (Hermès, LVMH, etc.) and quasi-monopolies in certain industries (Plastic Omnium, Coca-Cola, etc.). Banking stocks are also interesting: they would benefit from a possible rise in interest rates to offset inflation, which would allow them to increase their margins.

Cryptocurrency

The more responsible the crypto community becomes, the more all solid protocols will benefit, and cryptocurrencies will become a true hedge against inflation.

Cryptocurrencies currently follow stock market growth patterns, act as a good hedge against inflation during periods of stable growth, but fail in times of financial crisis.

As cryptocurrencies evolve, they will become an effective bulwark during these crises as well.

Investments to avoid in the face of inflation

Bonds and life insurance euro funds

If inflation returns, bond funds that are mostly positioned in fixed-rate European government bonds should be avoided. If inflation is higher than the fixed bond rate, you mathematically lose money. Note that life insurance Euro funds are mostly made up of these bonds and are therefore to be avoided in case of inflation. As an alternative, there are inflation-indexed bonds to protect you from this risk. Nevertheless, recent increases in central bank policy rates have led to renewed interest in new bond issues, whose rates are now more attractive.

Bank passbooks

The rate of bank passbooks, and in particular the Livret A (revised to 2% on 1er August 2022), does not fully cover inflation. Again, as with bonds, if the inflation rate is higher than the passbook’s yield, you mathematically lose money. You can calculate the actual passbook yield by subtracting the theoretical yield from the value of the inflation rate to arbitrate on the suitability of the passbook for your investments.

Defensive stocks in the stock market

Defensive stocks in the stock market (such as shares of companies in the basic consumer goods sector or the utilities sector) will sometimes have difficulty adjusting their prices upwards (low pricing power or pricing power) as costs rise, directly impacting operating margins. However, they can count on stable demand as populations maintain their needs for food, water, waste management and electricity. If these companies are highly leveraged, a decline in operating margins puts them at risk. They could have difficulty repaying their debt and this financial imbalance could impact the price of these stocks on the stock market.