TL;DR

- Michael Saylor renews his call for the creation of a Bitcoin Strategic Reserve for the United States, supported by the victory of a pro-crypto candidate like Trump.

- The proposal aims for the U.S. to acquire between 20% and 25% of the global Bitcoin supply to strengthen its financial position against rivals like China and Russia.

- Despite criticism from lawmakers like Kirsten Gillibrand, the financial sector shows growing interest in Bitcoin, with institutions like Bank of America increasing their investments.

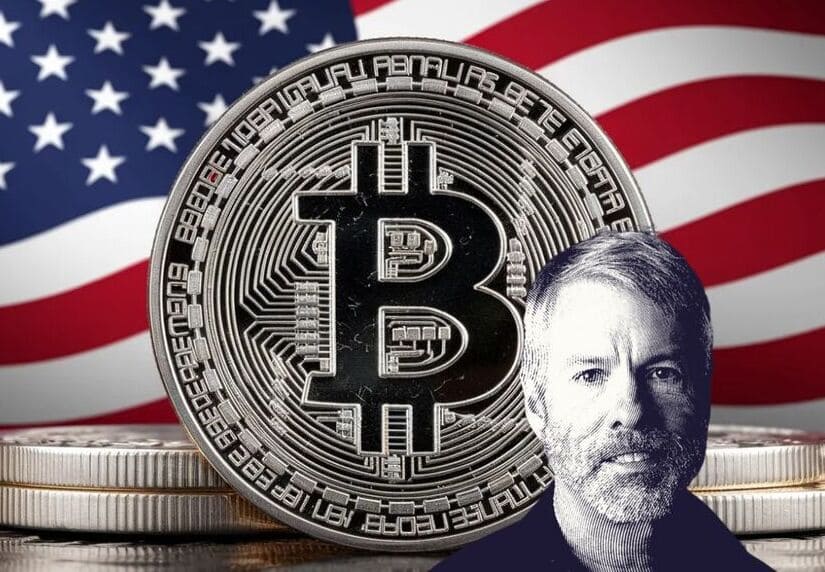

Michael Saylor, former CEO of MicroStrategy and one of the strongest advocates for Bitcoin, has renewed his call for the creation of a Bitcoin Strategic Reserve for the United States, a proposal that has gained relevance following the victory of a pro-crypto candidate in the U.S. presidential elections.

Donald Trump, who recently suggested the same idea, has sparked the debate, highlighting the importance of incorporating cryptocurrency into the country’s economic strategy.

The United States should buy #Bitcoin and sell Gold.pic.twitter.com/HD69iy1EAO

— Michael Saylor⚡️ (@saylor) December 7, 2024

Saylor has expressed his enthusiasm for the victory of a president with a favorable stance on cryptocurrencies and considers it essential for the United States to seize this opportunity to structure a regulatory framework that is favorable to digital innovation.

According to Michael Saylor, the U.S. Should Acquire 25% of the Bitcoin Supply

His proposal to create a Bitcoin strategic reserve seeks to strengthen the country’s financial position, suggesting that purchasing large amounts of Bitcoin could be a way to secure economic supremacy against rivals like China and Russia. Saylor proposes that the United States should acquire between 20% and 25% of the global Bitcoin supply, which would not only strengthen its digital asset reserve but could also weaken other nations’ reliance on gold as a store of value.

However, the idea of a Bitcoin reserve is not without controversy. Lawmakers like Senator Kirsten Gillibrand have questioned the feasibility and purpose of this proposal, pointing out that convincing the public of the benefits of this measure could be more complicated than it seems. Despite the criticism, Saylor defends that the Bitcoin reserve represents a necessary strategy to maintain the financial leadership of the United States.

Meanwhile, the financial sector shows signs of growing confidence in Bitcoin. Recently, Steve Weiss, a former executive at Bank of America, revealed that the bank has increased its investment in Bitcoin, underscoring the growing adoption of the cryptocurrency by institutional investors. This shift in perspective among institutions could signal that cryptocurrencies are taking a more central role in traditional finance.