TL;DR

- Mt. Gox moved over 2,300 BTC, worth approximately $234 million, on December 12, 2024, coinciding with Bitcoin’s $100,000 milestone.

- These transfers could be signals of Mt. Gox’s creditor repayments, a process delayed until October 2025 due to technical issues.

- Market concerns are rising that these large BTC movements could trigger a massive sell-off, affecting the price of BTC and impacting the market.

A wallet linked to the Mt. Gox cryptocurrency exchange recently moved over 2,300 Bitcoin (BTC), equivalent to approximately $234 million.

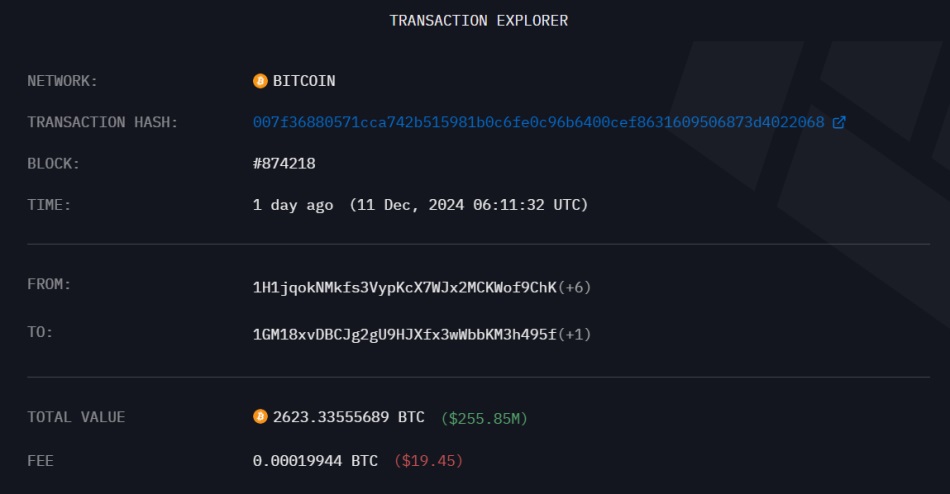

The transaction occurred on December 12, 2024, just after BTC reached the $100,000 mark, driven by market optimism about potential interest rate cuts by the U.S. Federal Reserve. This transfer adds to others made in the previous days, including one of 2,623 BTC (around $255 million) on December 11.

The series of transfers has caught the market’s attention, as they could signal the start of repayments to Mt. Gox creditors. In July 2024, the exchange announced it would begin reimbursing creditors in Bitcoin and Bitcoin Cash (BCH), a process that requires creditors to verify their accounts and register on platforms such as Bitstamp and Kraken to receive their funds.

Concerns Over Mt. Gox Movements and Massive Sell-Offs

Although the large BTC transfers seem to be part of this process, the official creditor repayments have not yet started, as the original payment deadline of October 31, 2024, has been extended to October 31, 2025, due to technical issues such as “duplicate deposits.”

Despite the uncertainty surrounding the exact purpose of these movements, there are concerns that these funds could lead to a massive Bitcoin sell-off, which could disrupt the market and its price. Mt. Gox, once the largest cryptocurrency exchange in the world, has been involved in numerous BTC movements in recent months, sparking speculation about the impact these reimbursements could have on the crypto market.

Meanwhile, Bitcoin continues to trade near the $100,000 mark, and its market capitalization has surpassed $2.12 trillion. With expectations that the U.S. government’s stance toward cryptocurrencies will become more favorable in 2025, many analysts anticipate that Bitcoin could continue to gain value in the coming months