Phoenix Group, a firm dedicated to cryptocurrency mining and blockchain technology, experienced a significant 50% increase in the value of its shares on its first day of trading on the Abu Dhabi Securities Exchange (ADX).

This achievement followed a successful Initial Public Offering (IPO) that raised $370 million. Phoenix’s IPO marked a milestone as it became the first public listing of a cryptocurrency-related company in the Middle East.

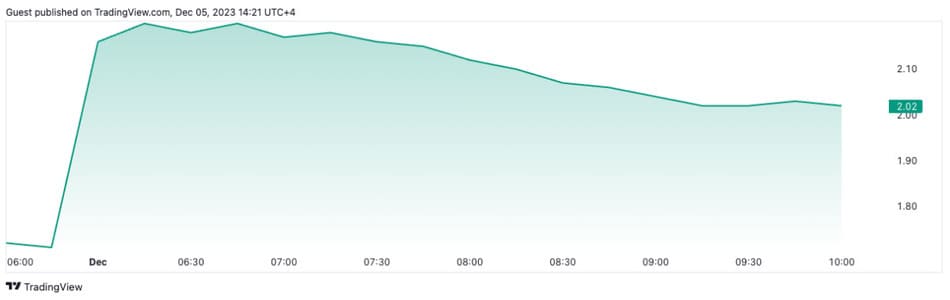

Phoenix’s shares (PHX) started trading at 2.20 United Arab Emirates dirhams (approximately $0.60), representing a significant increase from the IPO price of 1.50 dirhams ($0.41). Although the price experienced a slight correction, it currently stands at 2.02 dirhams according to TradingView data.

Phoenix’s IPO attracted considerable attention, being oversubscribed 33 times, generating orders of around $12 billion. The company made over 900 million shares available at a price of 1.50 dirhams per share. Representing a 17.6% stake in the company’s share capital. Retail investors showed notable interest, oversubscribed by 180 times, while professional investors oversubscribed by 22 times. Phoenix’s post-IPO valuation is estimated at approximately $2.5 billion.

This achievement not only marked the first public listing of a cryptocurrency-related company in the region. But also demonstrated widespread interest in cryptocurrencies and blockchain technologies. The positive response from retail and professional investors highlights the growing appetite for cryptocurrency-related investments in the United Arab Emirates and the region.

Phoenix Aims for Sustainable Mining

In its statement, Phoenix Group highlighted its strategic initiatives, including a partnership with the Abu Dhabi government. This collaboration is presented as an innovative fusion of public policy and private sector innovation. The company also emphasized its commitment to environmental sustainability, emphasizing the development of the largest hydropower mining farm in Abu Dhabi.

Phoenix’s IPO positions itself as a milestone not only for the company. But also for the crypto ecosystem in the region. Where measures are being taken to attract and favorably regulate cryptocurrency-related businesses. Phoenix’s successful entry into the public market could set a precedent for future public offerings by other companies in the region.

Other Bitcoin mining companies, such as CleanSpark, also experienced significant increases in their shares. This event is partly due to renewed interest and confidence from investors in the market. Bitcoin, Ethereum, and other cryptocurrencies saw considerable price increases during the year, highlighting the overall bullish trend in the market.