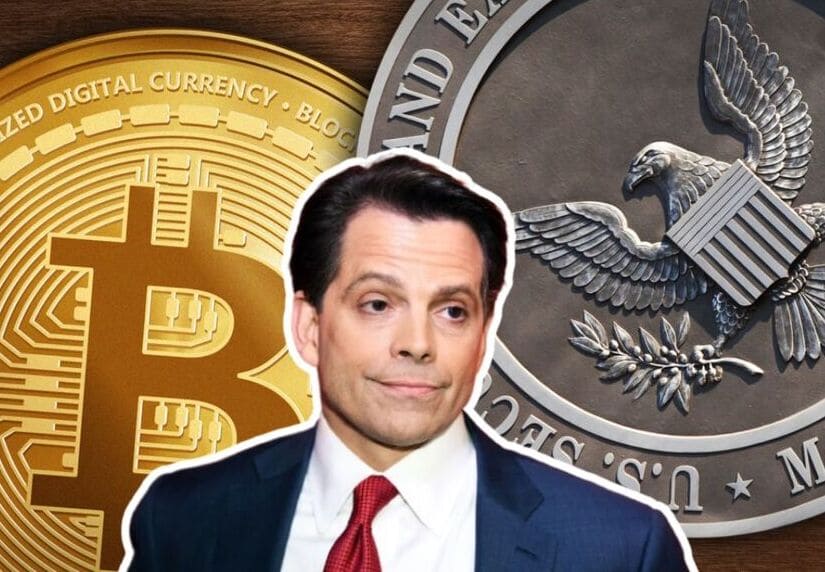

Anthony Scaramucci, founder of SkyBridge Capital and former White House Communications Director. Made an optimistic prediction this week by suggesting that the United States Securities and Exchange Commission (SEC) could approve a Bitcoin Cash Exchange-Traded Fund (ETF) in the coming days.

Scaramucci, known for his active involvement in the cryptocurrency space, has put forth this idea at a strategic moment. Indicating that it might be an opportunity to “bury the news” when public attention is not focused on this matter.

Just a theory: and don’t be surprised if it happens, but it feels like the bitcoin cash ETF could be approved next week. It’s a holiday week and it’s also a way to bury the news when people aren’t paying attention. Classic news dump. Market isn’t expecting it. Be ready.

— Anthony Scaramucci (@Scaramucci) December 22, 2023

Bitcoin Cash, a cryptocurrency that emerged in 2017 as a result of a hard fork from the original Bitcoin blockchain, is the focal point of this prediction.

This statement comes amid a series of applications from various companies. Such as BlackRock, Grayscale, Fidelity Investments, WisdomTree Inc., Ark Invest, and 21Shares. Who have filed applications to launch a Bitcoin ETF in the traditional market. While most of these applications were submitted in June, some of these companies have made additional amendments in recent months. Despite these efforts, none of the applications has yet received approval from the SEC.

Scaramucci is Clear on This; He Knew That Everyone Would Go For the Bitcoin ETF at Some Point

The relevance of this prediction lies in the exceptional performance of SkyBridge Capital’s cryptocurrency investments, as announced last week. The company’s fund, which includes Bitcoin, Ethereum, and Solana, has experienced a 130% increase. Additionally, the company’s Bitcoin funds are estimated to have increased by as much as 127%.

Scaramucci had previously spoken about the possibility of a Bitcoin Cash ETF. Stating in a 2022 interview with The Block that “a Bitcoin cash ETF will happen sometime this year.” During a podcast, he shared details about large institutions, which, due to confidentiality reasons. He could not name at that time but were ready to seize the opportunity presented by the Bitcoin Cash ETF.

Scaramucci emphasizes the growing attention and involvement of financial institutions in the world of cryptocurrencies. As well as the ongoing evolution of regulation in this sector. Although the approval of a Bitcoin Cash ETF would be a significant milestone, there is still time to learn about the SEC’s final resolution.