Terraform Labs, which has one of the most devastating bankruptcy incidents in the cryptocurrency ecosystem and has been dealing with legal upheavals as a result of its breaching of securities laws and money laundering, has again caught headlines.

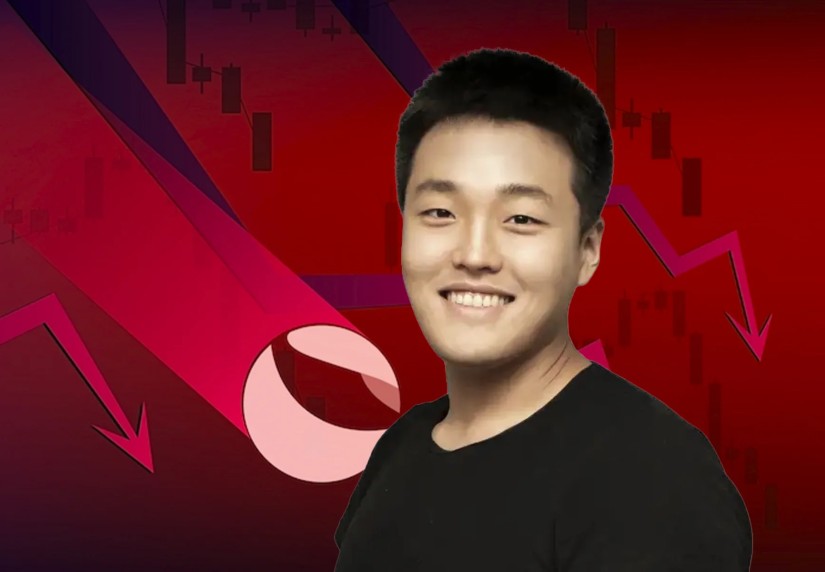

According to a press release on February 16, the United States Securities and Exchange Commission has charged Do Kwon, the embattled Co-Founder, and Chief Executive Officer of Terraform Labs, and the company for coordinating a multi-billion dollar crypto assets securities fraud. The charges involve the company’s TerraUSD (UST), an algorithmic stablecoin, and the LUNA token.

Meanwhile, the complaint filed in the U.S. District Court for the Southern District of New York charged the defendants with breaching the anti-fraud registration and provisions of the Securities and Exchange Act. The investigation was carried out and supervised by several attorneys and cyber units in order to bring the firm to accountability.

SEC Says Do Kwon and his Firm Deceived Investors

Before the collapse of Terra USD in May 2022, Kwon and Terraform Labs sold out varieties of crypto assets securities. The regulator said the assets were unregistered but offered to notable investors, promising them up to 20% profit thereby making billions of dollars from them.

While doing this, both parties were laying claims on assets that will appreciate in value and deceived investors about the stability of UST. Unfortunately, the price of LUNA became unstable causing both Terra/LUNA to collapse.

Hence, the SEC Chair, Gary Gensler alleges that Terraform and its CEO have failed to provide adequate, truthful, and detailed information to the investors as required for a range of crypto assets securities, most especially for LUNA and Terra USD. Likewise, the defendants have been charged for continuously providing investors with misleading information to gain their trust and afterward causing huge losses to them.

As such, the SEC is committed to ensuring that no matter how long it will take, the crypto firm must comply with the security law. The regulator has brought related charges on other crypto firms in recent months.

Meanwhile, the whereabouts of Do Kwon the co-founder of the Singapore-based firm has remained largely unknown and several efforts to bring him to book have so far yielded no positive results. Even though the South-Korean national claimed not to be in hiding, Interpol in September 2022 issued a Red Notice for Kwon alerting enforcement agencies worldwide.