TL;DR

- Spark launched Liquidity Layer to enable conversions between USDC, USDS, and sUSDS across multiple blockchains, improving liquidity and yields.

- It will initially operate on Ethereum, with plans to expand to networks like Base, Arbitrum, Polygon, Optimism, and Solana in December.

- Since September, USDS has reached $1.05 billion in market capitalization, with $759.5 million converted from DAI and $1.35 billion held in savings.

Spark, part of the Sky ecosystem, has announced a new feature aimed at enhancing the interoperability and utility of its USDS stablecoin.

The Spark Liquidity Layer allows users to perform conversions between USDC and USDS, as well as its yield-bearing version, sUSDS, across multiple blockchains. Its goal is to improve liquidity and expand USDS adoption across various networks, offering greater efficiency and speed compared to traditional bridging solutions.

Initially, Spark Liquidity Layer will operate on Ethereum. Plans are underway to integrate additional networks starting in December. Upcoming additions include Layer 2 scaling solutions such as Base, Arbitrum, Polygon, and Optimism, alongside the Layer 1 network Solana.

This multi-chain approach is designed to streamline stablecoin conversions and optimize yields across different blockchain ecosystems. The platform will also add support for USDT in the future.

The primary objective of this system is to enhance the multi-chain functionality of USDS by providing automated liquidity between USDC, USDS, and sUSDS on various networks. This not only increases the availability of USDS but also improves yield opportunities for users.

Spark Claims Superior Efficiency Over Other Solutions

The Spark team claims that this liquidity layer offers greater speed and efficiency compared to traditional interoperability solutions. This marks a key advancement in the integration of diverse blockchain ecosystems.

Since its launch in September, USDS has seen rapid growth, though its adoption has stabilized in recent weeks. The stablecoin reached a market capitalization of $1.05 billion after briefly exceeding $1.29 billion in early November.

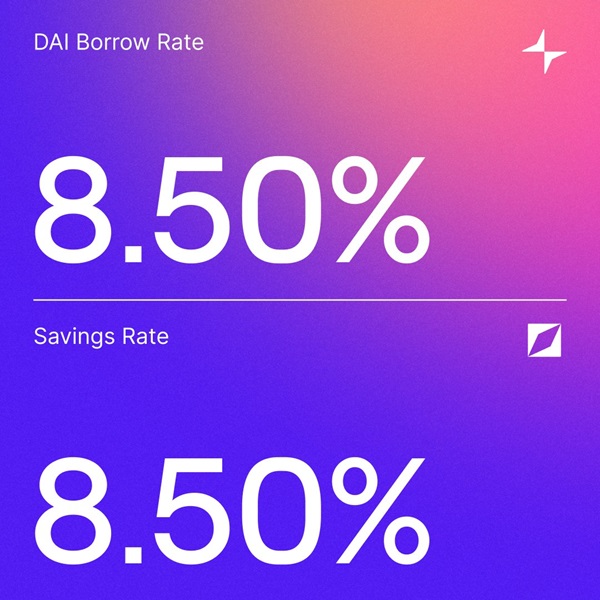

To date, users have converted $759.5 million from DAI to USDS. This accounts for 20% of the combined market capitalization of both stablecoins, which totals $5.27 billion. One-quarter of this amount, equivalent to $1.35 billion, is currently held in the Sky Savings Rate protocol