TL;DR

- Uniswap generated $52.75 million in fee revenue between April and September 2024 after raising its fees.

- The fee hike increased the rate from 0.1% to 0.25% for most pairs, excluding stablecoins and WETH.

- The exchange is under regulatory scrutiny by the SEC but remains the leader in trading volume with $8.1 billion.

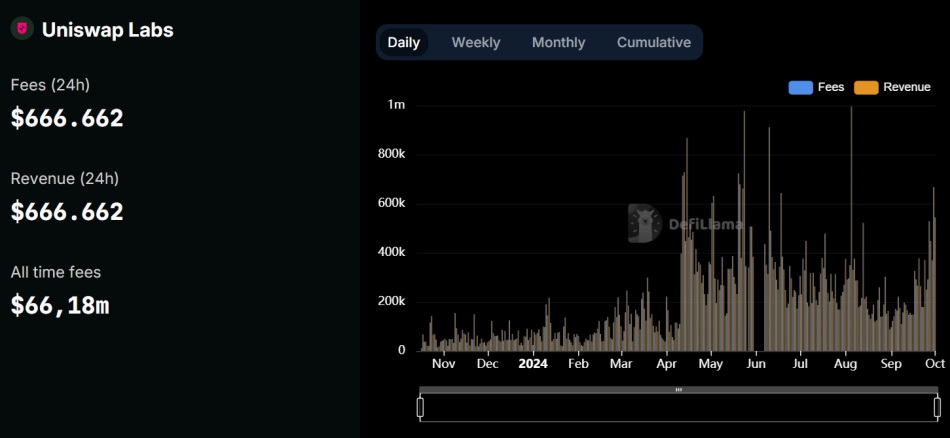

Uniswap, the leading decentralized exchange (DEX) by market volume, generated $52.75 million in fee revenue between April 1 and September 30, 2024, according to DefiLlama data.

The revenue increase followed Uniswap Labs’ decision to raise swap fees on its interface starting in April. This move has significantly boosted the platform’s earnings, partially driven by the growth of the decentralized finance (DeFi) sector.

The fee adjustment raised the rate from 0.1% to 0.25% for most token pairs, except for transactions involving stablecoins and Wrapped Ethereum (WETH). This fee applies exclusively to users swapping directly through Uniswap’s website, while those using aggregator platforms are not subject to this additional charge. Uniswap’s standard transaction fees range from 0.01% to 1%, depending on the token pair traded.

Criticism Over the Fee Hike

Although the fee increase generated criticism in some sectors, as expressed by Gabriel Shapiro, general counsel of Delphi Labs, the measure has produced positive results for the platform. Shapiro argued that the fee hike does not benefit UNI, Uniswap’s native token, which could create tensions between shareholders and token holders. Nonetheless, the platform’s trading volume continues to rise.

Data shows that in May 2024, following the implementation of the new fee scheme, Uniswap reached a monthly fee revenue record of $11.53 million. In September, revenue amounted to $7.31 million, a more moderate figure due to lower market activity during that month.

Uniswap Could Face a New Legal Battle with the SEC

Alongside its financial success, Uniswap continues to face intense regulatory scrutiny. In April of this year, the platform received a “Wells Notice” from the U.S. Securities and Exchange Commission (SEC), a step that often precedes potential legal action. In response, Uniswap expressed its readiness to defend its position in a legal battle and voiced its opposition to the SEC’s attempts to regulate the DeFi sector.

Despite these challenges, Uniswap remains the leading DEX by volume, recording $8.1 billion in trades over the past week, surpassing competitors like PancakeSwap.