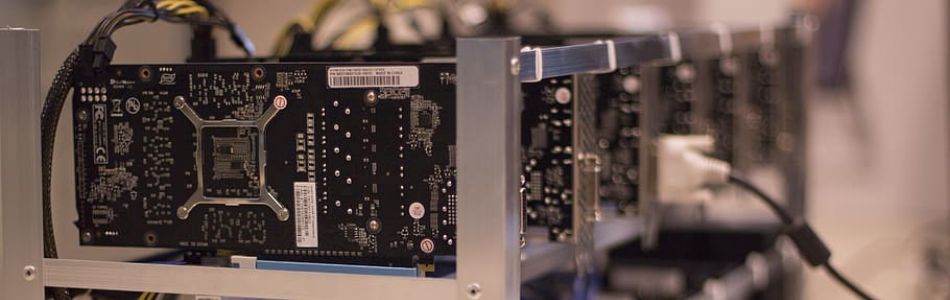

In recent years, digital currency mining has become a rapidly growing industry, with miners utilizing vast amounts of energy to power their operations. As concerns mount over the environmental impact of this energy consumption, White House advisers are renewing their push for a 30% Digital Asset Mining Energy (DAME) tax.

The White House Tax Push

The proposed tax would target the energy-intensive process of mining digital currencies such as Bitcoin (BTC), Ethereum (ETH), and others. The tax would be levied on the energy consumption of these mining operations, with the goal of forcing miners to reduce their energy usage and transition to more sustainable energy sources.

Meanwhile, the push for a digital mining energy tax is not a new development. In fact, it has been a topic of discussion among policymakers and industry experts for years, with many advocating for a tax on the energy consumption of digital mining operations. However, the recent surge in the value and popularity of digital currencies has brought renewed attention to the issue.

Proponents of the tax argue that digital mining is a significant contributor to greenhouse gas emissions and energy consumption. According to estimates, Bitcoin mining alone consumes more energy than the entire country of Argentina. By imposing a tax on this energy consumption, the government can incentivize miners to reduce their energy usage and invest in more sustainable energy sources.

Opponents of the tax, on the other hand, argue that it could stifle innovation in the digital currency industry and drive mining operations to countries with less stringent regulations. They argue that a tax on digital mining energy consumption would be unfair, as other industries with high levels of energy consumption are not subject to similar taxes.

In conclusion, the proposed digital mining energy tax is a controversial topic that has been the subject of debate among policymakers and industry experts for years. Additionally, the renewed push for a 30% tax on digital mining energy consumption by White House advisers reflects growing concerns over the environmental impact of digital currency mining.

While the tax has its proponents and opponents, it remains to be seen whether it will be implemented and what its impact will be on the digital currency industry.

Reiterating the Environment Impacts of Mining

In support of the taxation, the US Treasury argued that energy use by crypto mining operations “has negative environmental effects”, raising costs for customers who share a grid with the activities, and poses “uncertainty and risks to local utilities and communities”.

Recall that Core Scientific, a blockchain firm has announced that it is filing for Chapter 11 bankruptcy protection as a result of the firm’s dwindling income and low prices of BTC in the crypto market.